AccountDebitCreditSales Revenue275,000Interest Revenue150Income Summary275,150To close revenue accounts with credit balances.2. We will close sales discounts, sales returns and allowances, cost of goods sold, and all other operating and nonoperating expenses. Transactions made to contra accounts are presented on a company’s financial statements under the related account. Contra accounts are important because they allow a company to follow the matching principle by recording an expense initially in the contra asset account. Another example of a contra asset account is the accumulated depreciation account which reduces the reporting value of capital assets.

What are some examples of contra accounts?

They also help to provide a clear picture of a company’s financial health and performance. In accounting, a contra account is a general ledger account that offsets the balance of another general ledger account. A contra account is used to reduce the value of an asset or liability account, which results in a net balance that reflects the true value of the account. Accumulated depreciation is used to offset the balance of a fixed asset account.

Permanent and Temporary Accounts

Last, for contra revenue accounts there are sales discounts, sales allowances, or sales returns. These contra revenue accounts tend to have a debit balance and are used to calculate net sales. Company K’s income statement will report the gross Sales of $100,000 minus the sales returns and allowances of $500 and the resulting net sales of $99,500. Allowance for doubtful accounts is a common contra asset listed on a company’s balance sheet under accounts receivable. When a company sells its products or services to customers on credit, the company records the amount sold in its accounts receivable account.

What is a contra account?

Contra equity reduces the total number of outstanding shares on the balance sheet. The key example of a contra equity account is Treasury stock, which represents the amount paid to buyback stock. Using contra accounts in financial analysis can provide valuable insights into a company’s management and transparency. By showing adjustments and reductions made to certain accounts, investors and analysts can better understand a company’s financial health and potential risks. Discount on notes payable is a contra liability account that is used to offset the balance of the notes payable account.

- Unlike an asset which has a normal debit balance, a contra asset has a normal credit balance because it works opposite of the main account.

- As a contra revenue account, sales discount will have a debit balance and is subtracted from sales (along with sales returns and allowances) to arrive at net sales.

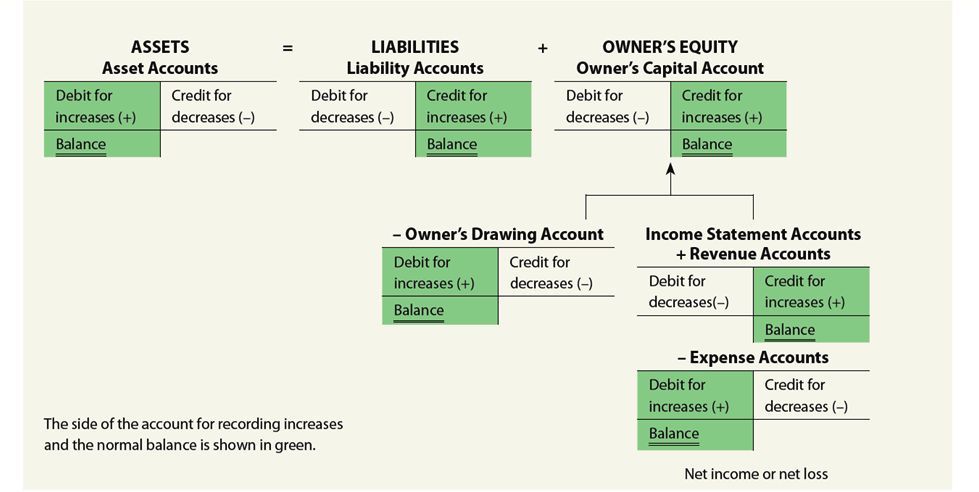

- Since expenses are usually increasing, think “debit” when expenses are incurred.

- This can be particularly useful for investors and other stakeholders who are interested in understanding the true financial health of a company.

Accumulated depreciation reflects the reduction in value of a fixed asset. There are several types of contra accounts, including accumulated depreciation, allowance for doubtful accounts, and sales returns and allowances. Each type of contra account represents a different aspect of a company’s financial position. A contra revenue account carries a debit balance and reduces the total amount of a company’s revenue. The amount of gross revenue minus the amount recorded in the contra revenue accounts equal a company’s net revenue.

Is Unearned Revenue a Contra Account?

They are used to reduce the value of an asset or liability account to its net balance. If the rented space was used to manufacture goods, the rent would be part the usual balance in a contra-revenue account is a: of the cost of the products produced. In other words, its expected balance is contrary to—or opposite of—the usual credit balance in a revenue account.

For example, Accumulated Depreciation is a contra asset account, because its credit balance is contra to the debit balance for an asset account. This is an owner’s equity account and as such you would expect a credit balance. Other examples include (1) the allowance for doubtful accounts, (2) discount on bonds payable, (3) sales returns and allowances, and (4) sales discounts. For example net sales is gross sales minus the sales returns, the sales allowances, and the sales discounts. The net realizable value of the accounts receivable is the accounts receivable minus the allowance for doubtful accounts. There are four key types of contra accounts—contra asset, contra liability, contra equity, and contra revenue.

Contra revenue accounts are used to offset the balance in a revenue account. For example, if a company has a revenue account for sales returns and allowances, they would also have a contra revenue account to offset the balance in the sales returns and allowances account. For example, a contra account to accounts receivable is a contra asset account. This type of account could be called the allowance for doubtful accounts or bad debt reserve.

Allowance for obsolete inventory or obsolete inventory reserve are also examples of contra asset accounts. Sales returns is a contra revenue account as the figure is a negative amount net against total sales revenue. It would appear on the company’s income statement in the revenue section. The contra revenue accounts commonly used in small-business accounting include sales returns, sales allowance and sale discounts.

Sales allowance represents discounts given to customers to entice them to keep products instead of returning them, such as with slightly defective items. The sales discount account represents the discount amount a company gives to customers as an incentive to purchase its products or services. Accumulated Depreciation acts as a subaccount for tracking the ongoing depreciation of an asset. Each year of an asset’s life, another year of Depreciation Expense is recorded.

Whereas assets normally have positive debit balances, contra assets, though still reported along with other assets, have an opposite type of natural balance. Transactions that involve contra accounts are recorded in the general ledger, which is a record of all financial transactions made by a company. The general ledger is used to create financial statements such as the balance sheet and income statement. Discount on bonds payable is a contra liability account that is used to offset the balance of the bonds payable account. It represents the amount of discount that was given when the bonds were issued.